Financial stability is crucial for business growth. Understanding how to leverage a Free Business Credit Report can be the first step towards achieving this stability. For small businesses, attaining proper funding is essential. In this guide, learn about Small Business Funding Options and how to Build Business Credit Faster.

Your Guide to Free Business Credit Reports

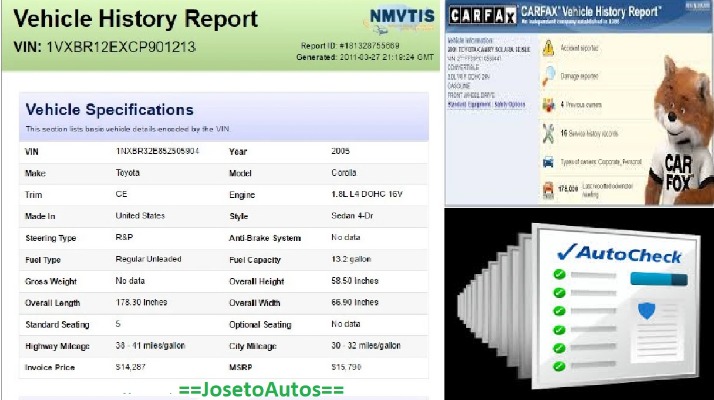

Accessing Free Business Credit Reports provides an overview of your business’s credit standing. These reports can be an invaluable tool, outlining your credit history, financial health, and risk factors. Proactively managing your credit can lead to better financing opportunities. Regularly Access Your Business Scores to stay updated on your credit status.

Why You Need Free Business Credit Reports

Understanding the importance of Free Business Credit Reports can’t be overstated. These reports are essential for several reasons:

- Risk Management: Detect discrepancies or fraudulent activity.

- Better Loan Terms: Improved credit scores can secure lower interest rates.

- Vendor Relations: Strong credit reports promote trust with suppliers.

Exploring Small Business Funding Options

Securing funding can be challenging, but many Small Business Funding Options are available to help. These options vary in terms of accessibility, interest rates, and repayment terms. Awareness of these choices allows for informed decision-making that aligns with your business growth strategy.

Common Small Business Funding Options

Considering different funding avenues can optimize growth and stability. Here are some popular Small Business Funding Options:

- Term Loans: Fixed amounts with specified repayment schedules. Ideal for significant investments.

- Lines of Credit: Flexible funding for ongoing expenses and operational costs.

- Invoice Financing: Advances on unpaid invoices to improve cash flow.

Strategies to Build Business Credit Faster

Establishing and scaling a business often necessitates a strong credit profile. It’s important to Build Business Credit Faster to seize growth opportunities. Consistency, responsibility, and strategic planning are keys to enhancing your business credit swiftly.

Effective Steps to Start Building Business Credit

Initiating the process to Start Building Business Credit involves several critical steps:

- Register Your Business: Ensure your business is legally recognized.

- Bank Accounts: Separate personal and business finances.

- Vendor Credit: Establish and maintain credit lines with suppliers.

- Timely Payments: Consistent, on-time payments improve your credit score.

Read more about Small Business Funding Options here.

By leveraging Free Business Credit Report tools, exploring various Small Business Funding Options, and adopting rapid credit-building strategies, your company can achieve its ambitious growth objectives efficiently. Regularly Access Your Business Scores to monitor and enhance your credit profile, paving the way for financial success.